Nicholas Kristof & Sheryl WuDunn discuss ways to address opportunity gap

Posted: October 3, 2014 Filed under: Education, General, Income Leave a comment »Pulitzer Prize-winning journalists Nicholas Kristof and Sheryl WuDunn’s new book “A Path Appears” looks at barriers to opportunity around the world, and what can be done to overcome them. Some of those barriers are already in place at the beginning. As WuDunn puts it, some kids are born “behind the starting line.” She says a child born in the bottom 20 percent of the economic spectrum has a one in 12.7 percent chance of making it to the top 20 percent.

WuDunn and Kristof spoke at Sacred Heart University on Friday to talk about the book. WSHU’s Craig LeMoult asked them about the gap, and how it can be addressed with early intervention.

WuDunn says by the age of four, a child of professionals has heard 30 million more words than the child of parents on welfare. That gap can make a significant difference in a child’s development.

“Part of that is an income issue,” says Kristof. “People don’t have resources for babysitter, or may send somebody to a child care program that may be inadequate. But it’s also, to some degree, cultural.”

Kristof says the gap between wealthy and poor children is increasing.

“Middle class parents have been investing more and more and more in their kids’ enrichment programs, and sending their kids to music lessons, then chess lessons, and soccer practice,” he says. “So the gap in those enrichment programs has gotten greater over the last generation, rather than smaller.”

But, Kristof says, it’s a mistake to think there’s not much that we can do to narrow that gap. Here’s what they had to say about early interventions that can make a difference:

“There are very very few people who don’t want the best for their kids,” says Kristof. “And where there are shortcomings, they may be raising their child the way they were raised. And if they get some support, some parental coaching, some help – especially with the incredibly difficult job of being a single parent – then they can dramatically improve those outcomes.”

In particular, Kristof and WuDunn point to the effectiveness of the Nurse Family Partnership, which provides coaching to new parents, even before a child is born. Teaching parents not to smoke or drink, and to breastfeed and hug a baby, can have a huge impact on a child’s development. They say families who get coaching from the Nurse Family Partnership see a 79 percent drop in state-verified child abuse, and the children are half as likely to be arrested by age of 15.

A program that’s working to close that 30 million word gap is Reach Out and Read, which provides books to low income families to help with the cognitive development of children. The program provides books, and doctors “prescribe” nightly bedtime stories to families. Here’s Kristof and WuDunn describing the program.

The cost is $20 per child per year. But Kristof says only a third of children who would benefit from the program in the U.S. get that intervention.

Kristof says unlike the U.S., economic inequality has declined globally. In particular, he says one of the great global changes has been an increase in literacy.

You can hear the full audio of Kristof and WuDunn’s discussion here.

Tell us what you know!

Posted: August 19, 2014 Filed under: General Leave a comment »State of Disparity wants to hear from you! How does inequality affect your community? How do economic differences impact how you interact with people in your life? Please click here and share your thoughts with us. It will only take a moment, and your input will help us tell stories here on the State of Disparity blog and on WSHU. Thank you!

Food insecurity in Fairfield County

Posted: November 26, 2013 Filed under: General, Nutrition Leave a comment »The Fairfield County Community Foundation released a report on food insecurity in the county, describing the trouble that many across the county face finding their next meal,

The report says most of the region’s food insecurity is still in the cities, but increasingly, families in suburban areas are having difficulty getting meals. Nancy von Euler of the Foundation says those families often don’t know about the resources available to them, like food banks and federal assistance. According to the report, 38% of Fairfield County families who are eligible to get federal food assistance don’t get the help. von Euler says part of the problem is that Fairfield County has among the highest costs of living in the country.

“So we have one of the highest food costs, per-meal cost of anywhere in the nation. Our housing costs are very high, our transportation costs are very high, our healthcare costs are very high,” says von Eueler. “And all of those things compound to put people at risk of not being able to have enough money to meet their food needs.”

The report says nearly 35,000 children in Fairfield County live in food insecure households, yet the state is last in the country for participation in the federal school breakfast program.

Wealthiest having much easier time bouncing back from recession

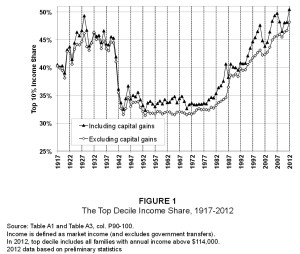

Posted: September 12, 2013 Filed under: General, Income, Politics Leave a comment »A new study by Emmanuel Saez at U.C. Berkeley says that the economic recovery has been far more generous to the wealthiest Americans than to the rest of the country. From 2009-2012, according to the study, incomes of the top 1% of Americans grew by 31.4% while the incomes of the other 99% grew just 0.4%. This chart from study shows what percentage of the total income share was held by the top 10% (decile) from 1917-2012.

Source: “Striking it Richer: The Evolution of Top Incomes in the United States” by Emmanuel Saez, UC Berkeley

As you can see, there was a serious drop-off around the time of World War II, and the levels stayed fairly constant between 30-35% until the late 1970s. They’ve now climbed back up to an all-time high.

The study was a topic of discussion today on the Diane Rehm Show on NPR. You can listen to that conversation here.

Stephanie Coontz of the Council on Contemporary Families said on the show that this is a long-term change.

“I think it’s a mistake to just think of it in terms of the recession,” she said. “It’s actually a 30 year process that has turned around all of the trends we had after the Great Depression and the move toward greater equality, and greater sense of community among the rich as well as the poor. I think the social implications of this are profound at all levels of society.”

Wall Street Journal columnist Dante Chinni, who directs the American Communities Project at American University discussed the causes of the growing disparity.

“You have the decline of good paying jobs, of manufacturing jobs,” he said. “And they were hard jobs, but they paid well. And they’ve disappeared. And that’s made life very hard. Also, automation. There are just fewer jobs available for people who don’t have a lot of education, and a lot of good skills training.”

The show’s other guest Columbia University journalism professor Thomas Edsall recently wrote a blog post for the New York Times on whether the government can actually do anything about inequality. On a somewhat related note, economist Steven Lanza looked at the issue of what difference government policies can make on the economy in Connecticut. His answer: not much. A WSHU story on his paper is here.

Also today, NPR Morning Edition’s Steve Inskeep spoke with Tyler Cowan, author of the book “Average Is Over: Powering America Beyond the Age of the Great Stagnation.” Cowan predicts the future means more people rising up to much greater wealth, as well as more clustering in a kind of “lower-middle class existence.”

“It will be a very strange world, I think,” he said. “We will be returning to historical levels of inequality. We’ll view post-war America as a kind of strange interlude not to be repeated. It won’t be the dreams that we all had that virtually all incomes go up in lockstep at three percent a year. It hurts to give that up. It will mean some very real increases in economic fragility for a lot of people.”

You can listen to Cowan’s conversation with Inskeep here.

What do you think? Let us know in the comments, email disparity@wshu.org or tweet us at @CTdisparity.

Conn. legislature considering minimum wage, retirement plan for low-income workers

Posted: May 8, 2013 Filed under: Education, General, Income, Politics Leave a comment »Connecticut’s legislative appropriations subcommittee approved two bills Tuesday related to economic disparity issues – one that would raise the minimum wage, and another that takes steps toward creating a state retirement plan for low income workers.

Hear about both bills here:

dk_bills_130508

The first bill would raise the minimum wage from $8.25 to $9 an hour over the next year and possibly to $9.75 the following year. Democratic State Representative Beth Bye of West Hartford says in the past she voted against raising the minimum wage. But now she says workers need it more than ever:

“What we’re seeing is this widening income disparity, in our state and in our country,” said Bye. “For people who are working full time I think we need to offer this as a way to help them to buy food and afford housing”

State Representative Mitch Bolinsky, a Newtown Republican, says the bill would prevent companies from hiring new employees, particularly teenagers. “The unemployment rate for that class of individual is three times higher than the state rate I see this as a job killing bill and a reason to have more kids on the street with nothing to do this summer,” said Bolinsky.

The bill is different from what Governor Dannel Malloy has proposed, which is to raise the minimum wage by 75 cents over the next two years. The committee bill still needs to be taken up by the House and Senate.

Also, the Appropriations Committee approved a bill that would require an initial feasibility study of a state administered retirement plan for low income workers. It made it through the committee on a mainly party line vote on Tuesday. Representative Jason Perillo of Shelton was one of a number of Republican members of the committee who voted against the bill. Perillo says there are plenty of private firms available to administer retirement plans for low income workers. The bill requires the Connecticut Retirement Security Trust Fund Board to set-up a low income workers fund, if the market feasibility study finds that such a fund would be self-sustaining. The bill heads to the Senate for further action.

Food insecurity a complicated problem in Conn.

Posted: April 10, 2013 Filed under: General, Health, Income, Nutrition Leave a comment »

Katherine Sebastian-Dring who work at the Gemma E. Moran United Way Labor/Food Center stands on the left, next to Bob Davoy who runs a food pantry in downtown New London. Mary Gates (right) is an Americorp VISTA for the New London Food Policy Council.

Recently a national anti-hunger advocacy group ranked Connecticut as the 6th best state for access to affordable and nutritious food—what’s also called community food security. But a study released Wednesday by UConn’s Zwick Center for Food and Resource Policy shows that things are pretty tough in some areas.

You can hear Will Stone’s report on food insecurity here:

ws_foodsecurity_130409

1 in 6 children in New London County is food insecure. That means they and their families don’t have reliable access to affordable food for a number of reasons—transportation, education, geography and income, all play a role.

It’s not all about economic disparity for this issue. The per capita income in the city of New London is $21,000, while neighboring Stonington is almost twice that. But the report shows Stonington still has a higher than average risk of food insecurity.

“Every town in the county has an at-risk population,” says Mary Gates, who’s been conducting focus groups on food insecurity for the New London Food Policy Council. “I want to make sure that people don’t look at Stonington or Mystic and say there can’t be hungry people there.”

Conn. NAACP describes “urban Apartheid”

Posted: April 10, 2013 Filed under: Employment, General, Housing, Income Leave a comment »NAACP members in greater New Haven are calling on the federal and state government to re-examine the disparities between low-income people of color in urban neighborhoods and white people in the suburbs. The report, called “Urban Apartheid,” looks at disparities in areas like education, income, and housing.

You can hear Will Stone’s story on the report here:

ws_naacp_130329

NAACP Chapter President James Rawlings says the findings show that place matters. He means neighborhoods in and around New Haven where, for example, the poor are six times less likely to have access to transportation, which in turn affects their chances of employment. A quarter of African American men in the region were unemployed in 2011. Rawlings says it all comes back to the educational achievement gap, and he says the key is removing children from what he calls “unhealthy communities.”

“The transportation system isn’t there to support the children, libraries are not there to support the child, the family wrap-around services are not there to support the child,” he says.

The NAACP is recommending that affordable housing be placed in more suburban communities, where the air is cleaner and there’s less crime.

Brookings: income inequality sticking around

Posted: March 22, 2013 Filed under: General Leave a comment »A new study by the Brookings Institution says that the rise in inequality in the U.S. comes from significant changes in income over time. Co-author Bradley Heim told the Huffington Post, “it’s not that the rich will stay rich and the poor will stay poor, but that they are relatively less likely to switch positions than they were before.” HuffPo reports that according to the Economic Policy Institute, “the incomes of the top 1 percent of households spiked 241 percent between 1979 and 2007, while the incomes of the middle fifth grew just 19 percent, when adjusted for inflation.”

The Brookings study also suggests increasing federal taxes on the rich only modestly reduces inequality.

Report: Conn. among worst for home ownership, credit card debt

Posted: January 30, 2013 Filed under: General, Housing Leave a comment »A new report from an economic advocacy group ranks Connecticut among the worst states for affordable home ownership and credit card debt, and it raises some interesting economic disparity issues about the state. Listen to the story here:

cel_cfed_130130

The national study from the DC-based Center for Enterprise Development found that in Connecticut, 37% of households don’t have enough money to cover basic expenses for three months if they lose their income.

“What I think is surprising is how far up the income scale liquid asset poverty reaches,” says Jennifer Brooks, director of state and local policy at CFED. She says 15% of Connecticut households that earn between $65K and $107K a year don’t have three months worth of savings.

Where Connecticut really stands out in the report is home ownership. The state ranks 42nd on the study’s measure of home affordability, which compares household income to median housing value. And the report says 41% of households in CT are paying more than a third of income for mortgage & other housing costs. And more than half of renters are using up that much of their income on housing. Brooks says there’s a huge disparity in home ownership based on income. She acknowledges it’s not surprising that high income families are more likely to own homes than low income families.

“I think that fact that Connecticut ranks 46th on this disparity measure is important, so the gap in CT is much bigger than it is in many other states,” she says.

The report shows there are also home ownership disparities based on race and family structure. It also says the average credit card debt in Connecticut is $15,000, second only to Washington DC.

CFED recommends a dozen policy recommendations in its report, including suggestions on how to reduce credit card debt and improve homeownership rates.

Nobel laureate Joseph Stiglitz: Inequality is holding back the recovery (Paul Krugman disagrees)

Posted: January 22, 2013 Filed under: Education, Employment, General, Income, Politics Leave a comment »The New York Times launched a new blog this week called The Great Divide, looking at inequality in the U.S. The blog is moderated by Joseph E. Stiglitz, a Nobel laureate in economics, a Columbia professor and a former chairman of the Council of Economic Advisers and chief economist for the World Bank. Stiglitz wrote the initial post in the blog, entitled “Inequality is holding back the recovery.”

“Politicians typically talk about rising inequality and the sluggish recovery as separate phenomena, when they are in fact intertwined,” Stiglitz writes. “Inequality stifles, restrains and holds back our growth.”

Stiglitz argues there are four major reasons inequality is squelching the recovery:

– The middle class is too weak to support the consumer spending necessary to drive growth

– The middle class is unable to invest in the future through education or starting/growing businesses

– The weak middle class holds back tax receipts needed for infrastructure, education, health, etc.

– Inequality leads to boom-and-bust cycles that make the economy more volatile and vulnerable

Stiglitz blames the economic policies of both the Obama and Bush administrations for making things worse.

“Instead of pouring money into the banks, we could have tried rebuilding the economy from the bottom up. We could have enabled homeowners who were ‘underwater’ — those who owe more money on their homes than the homes are worth — to get a fresh start, by writing down principal, in exchange for giving banks a share of the gains if and when home prices recovered. We could have recognized that when young people are jobless, their skills atrophy. We could have made sure that every young person was either in school, in a training program or on a job. Instead, we let youth unemployment rise to twice the national average. The children of the rich can stay in college or attend graduate school, without accumulating enormous debt, or take unpaid internships to beef up their résumés. Not so for those in the middle and bottom. We are sowing the seeds of ever more inequality in the coming years.”

He offers suggestions for President Obama’s second term.

“What’s needed is a comprehensive response that should include, at least, significant investments in education, a more progressive tax system and a tax on financial speculation.”

A lot to talk about here. Do you agree with Stiglitz’s arguments? Do you think inequality is holding us back from an economic recovery? What about his prescription for fixing it? Would education investment or a more progressive tax system make a difference?

Economist and New York Times columnist Paul Krugman (also a Nobel laureate) disagrees with him. In two responses to Stiglitz (Jan. 20 & Jan. 21), he says he’d love to blame slow growth on inequality. “But I couldn’t and can’t convince myself that the theory and evidence really support that view,” he writes in the second piece. “Inequality is a huge problem – but not for employment growth in 2013 or 2014.”

Recent Comments